News: Realty, airlines, auto dealers set to be worst hit by coronavirus-03-04-2020

Updated On: Apr 3, 2020

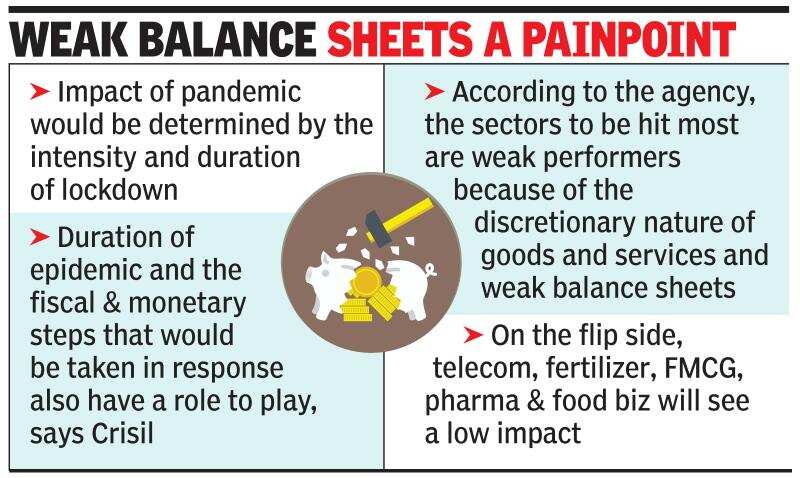

MUMBAI: Real estate, airlines, auto dealers, gems & jewellery and steel are the sectors that are expected to be the worst hit and have the least resilience in the ongoing Covid-19 crisis. While telecom, fertilizer, FMCG, pharmaceuticals and food industry will see a low impact and have higher resilience according to a report by ratings agency Crisil.

Meanwhile, ratings agency Moody’s revised the outlook on India’s banking system to negative along with 12 others in the Asia-Pacific region, citing coronavirus related disruption. “A sharp decline in economic activity and a rise in unemployment will, lead to a deterioration of household and corporate finances, which in turn will result in increases in delinquencies,” Moody’s said. Moody’s affiliate ICRA said that asset quality stress for lenders is likely to reflect with a lag of 1-2 quarters after the removal of the moratorium.

According to Crisil, the impact of the pandemic would be determined by the intensity and duration of lockdown, duration of the epidemic and the fiscal & monetary steps that would be taken in response. “It is a black swan event and puts us in a situation which cannot be modelled,” said Gurpreet Chhatwal, president of Crisil Ratings. The agency had recently cut its growth forecast to 3.5% and now believes that there are downside risks to even this number.

Around 4% of debt rated by Crisil is in sectors that are that are the least resilient category, mentioned earlier, and these are likely to see an adverse impact on credit quality. The sectors are expected to be weak performers because of the discretionary nature of goods and services and weak balance sheets. Of the 35 sectors that a Crisil study has looked at, 27 will face medium to a high level of disruption in the short erm.