News: Govt slashes small savings rates by up to 140 basis pts-01-04-2020

Updated On: Apr 1, 2020

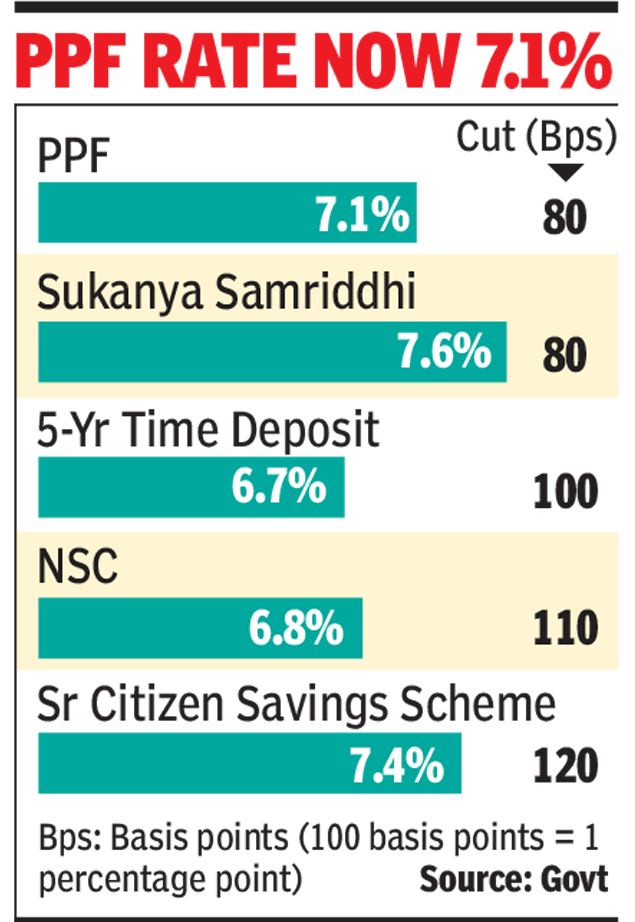

NEW DELHI: The government on Tuesday announced one of the steepest-ever cuts in small savings rates, which will see returns on the popular public provident fund deposits fall by 80 basis points to 7.1%, starting Wednesday, while the Senior Citizens Savings Scheme will see the annual interest rate drop by more than a percentage point.

Similarly, rates on post office term deposits have also been slashed by as much as 140 basis points with one- to three-year deposits now fetching 5.5% instead of 6.9% earlier. The rate on five-year term deposits has been pared by a percentage point to 6.7%. These deposits come with quarterly compounding of rates.

Even at the revised rates – which will be applicable for the April-June quarter -- the returns will be higher than what you will earn through a fixed deposit in a bank. For instance, for a five-year FD, State Bank of India is currently offering 5.7%.

Besides, some of the schemes such as PPF have the added tax benefit which results in higher returns. For instance, someone in the 30% bracket will earn a post-tax return of over 9%, apart from the tax benefit on investment of up to Rs 1.5 lakh. In a post-budget interview, economic affairs secretary Atanu Chakraborty had indicated to TOI last month, that rates will be lowered at the end of March.

Although the announcement move is in line with the falling interest rate regime, the government had earlier ignored its own policy and refused to align the returns with market rates. Even this time, it has done so due to repeated prodding by the Reserve Bank as the lower policy rates were not translating into a commensurate fall in deposit and lending rates.

While RBI has lowered policy rates by over 2 percentage points during the last couple of years, PPF rates have come down by 90 basis points since October 2016.